Interest Rates Are Finally Starting to Come Down — What That Means for the Summer Housing Market

After a prolonged period of elevated borrowing costs, interest rates are finally showing signs of easing. While rates are still higher than the historic lows of 2020–2021, the recent downward movement is already beginning to influence buyer behavior, investor confidence, and rental market dynamics—especially as we head into the summer season.

For homeowners, investors, and landlords in markets like Houston, this shift matters.

Why Rates Coming Down Is a Big Deal

Interest rates directly impact affordability. Even a small reduction in rates can significantly lower monthly payments, which:

-

Brings sidelined buyers back into the market

-

Improves cash flow projections for investors

-

Increases refinancing opportunities

-

Boosts overall market confidence

Over the last two years, many buyers paused due to uncertainty and affordability concerns. As rates begin to soften, that pent-up demand doesn’t disappear—it re-enters the market quickly.

What This Means for the Summer Buying Season

Summer is traditionally one of the most active real estate seasons, and lower rates tend to amplify that effect.

As borrowing costs ease, we expect to see:

-

Increased buyer competition, especially for well-priced homes

-

Faster days on market, particularly in desirable school zones

-

Stronger activity from investors who were waiting for better financing terms

-

Renewed interest from first-time buyers, putting pressure on entry-level inventory

In Houston specifically, where population growth and job stability continue to support housing demand, even modest rate reductions can lead to a noticeable uptick in transactions.

The Rental Market Impact: Demand Stays Strong

While lower rates may encourage some renters to become buyers, rental demand is not expected to weaken. In fact, the opposite often happens.

Here’s why:

-

Not all renters immediately qualify to buy, even with lower rates

-

Home prices remain elevated in many areas

-

Many households still prefer flexibility amid economic uncertainty

As a result, rental properties—especially professionally managed ones—continue to perform well. Strong screening, tenant retention, and proactive management become even more important as competition increases.

Why This Is a Strategic Moment for Investors

For investors, declining rates create opportunity:

-

Improved cash flow projections on new purchases

-

Potential refinancing opportunities on existing properties

-

Higher resale demand if exit strategies are part of the plan

-

More stable long-term returns as financing costs ease

However, increased activity also means more competition. Investors who move early—before rates drop further and demand spikes—are often in the strongest position.

What Landlords Should Be Thinking About Right Now

As market momentum builds, landlords should focus on:

-

Ensuring properties are well-maintained and competitively priced

-

Prioritizing tenant satisfaction and retention

-

Reviewing lease terms ahead of peak leasing season

-

Working with a property manager who understands market timing and risk management

The Bottom Line

Interest rates easing is a positive signal, but it’s not a return to the past—it’s a new phase of the market. Buyers are re-entering, competition is building, and summer activity is expected to accelerate.

For homeowners, investors, and landlords, the key is preparation. Those who understand the shift and act strategically will be best positioned to benefit.

If you’re considering buying, leasing, or repositioning a rental this summer, now is the time to start planning—not reacting.

Categories

- All Blogs (26)

- agent success (2)

- agent support (4)

- brokerage management (3)

- Buffalo Bayou (1)

- community (2)

- community support (2)

- Down Payment (7)

- Entertainment (4)

- Financing (11)

- first time home buyer (9)

- Foreclosure (1)

- Home Maintenance (3)

- Home Ownership (16)

- Home Upgrades (4)

- Homecoming (1)

- Houston (15)

- Houston Texans (2)

- mortgage (4)

- moving (12)

- Real Estate (15)

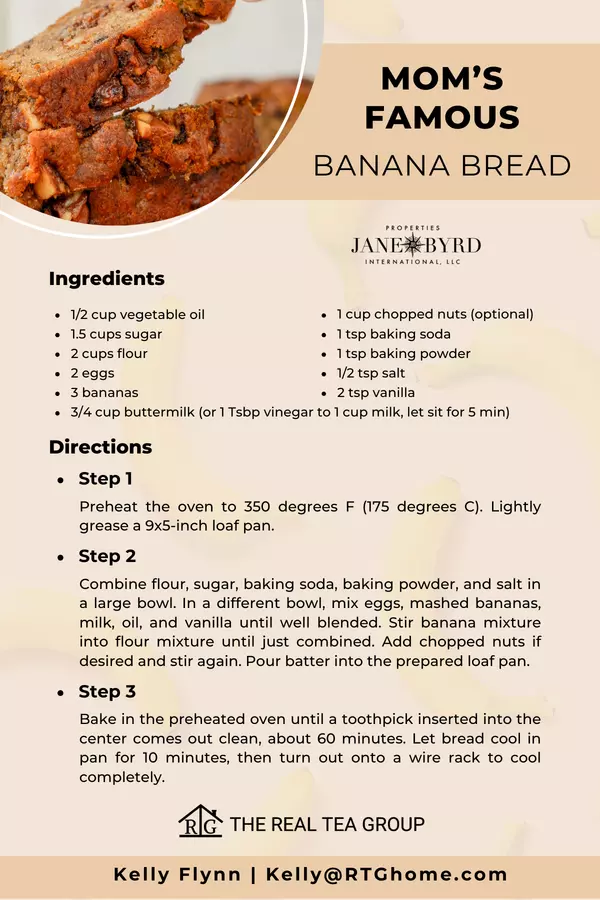

- Recipe (2)

- Restaurant Week (1)

- ROI (3)

- Selling my home (9)

- Theatre (2)

Recent Posts

GET MORE INFORMATION